Protecting large expenses like homes and cars with insurance is a no-brainer for most people, but how often do Americans insure other big life purchases like engagement rings? Jewelry may not be the first item that comes to mind when thinking of insurance, yet nearly all of us have felt the pit in our stomach when we’ve lost or misplaced a sentimental piece of jewelry. As a national family-owned fine jeweler, we wanted to dig deeper into jewelry insurance habits across the US.

We surveyed more than 3,200 Americans to find out what their most valuable piece of jewelry is, what threats they’re worried about, and the steps they are or aren’t taking to protect their jewelry. We also checked with Zillion, which specializes in personal jewelry insurance that provides worldwide coverage against theft, total loss, accidental damage, and disappearance.

Key Findings

- The price of a jewelry piece is the number one attributing reason as to why Americans would buy jewelry insurance, with 7 in 10 Americans feeling this way.

- On average, Americans feel as though a piece of jewelry needs to cost about $6,000 before they would consider insuring it.

- Comparatively, more Americans (34%) are worried about damaging their jewelry than they are about it being lost (31%) or even stolen (27%).

- On average, 1 in 5 Americans will wear fake jewelry in order to keep their real pieces safe from damage or theft, with about 30% of females claiming to do so.

- Less than half of Americans (46%) will use a safe when traveling when one is readily available.

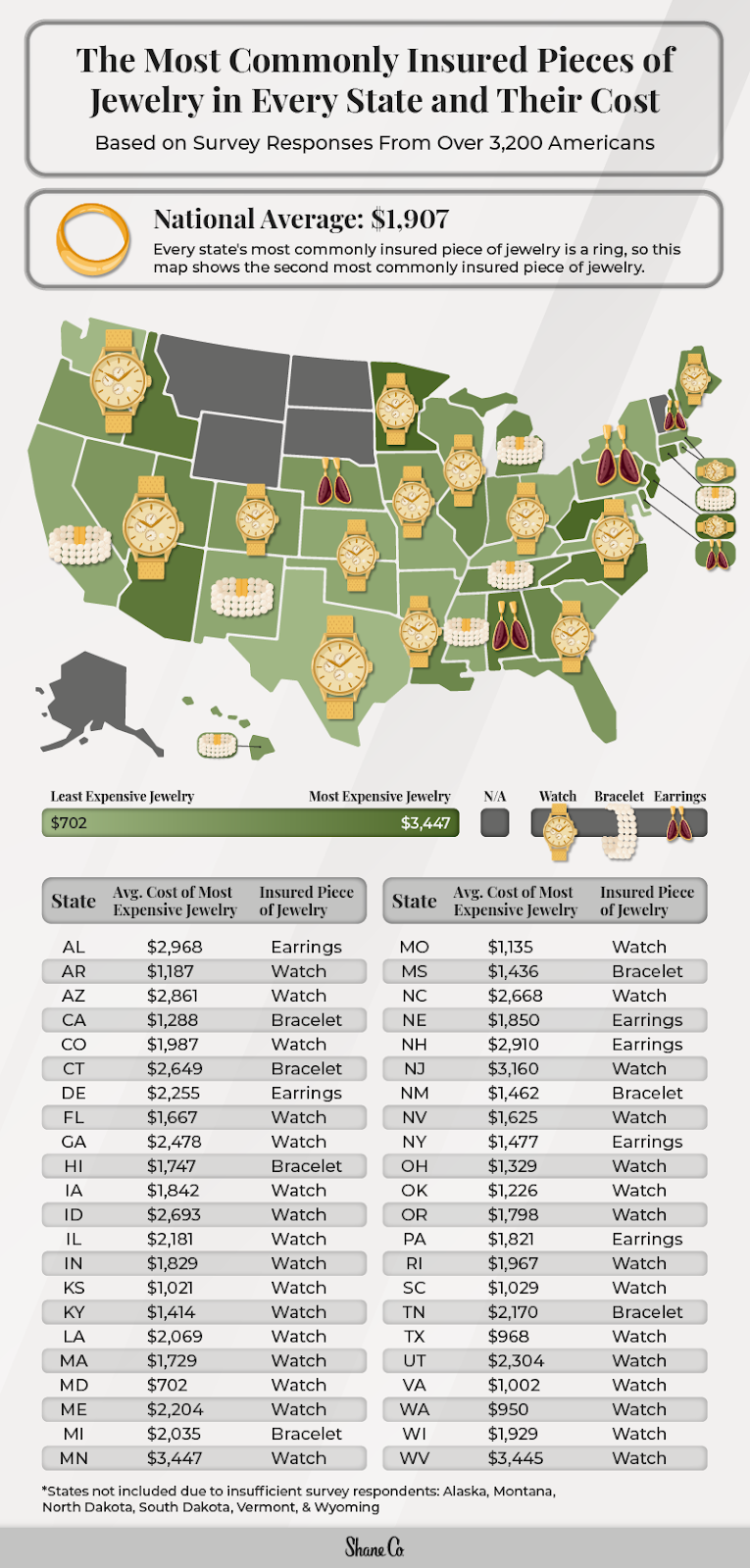

The Most Commonly Insured Pieces of Jewelry in Every State and Their Cost

Sorry, Jessie J, we can’t forget about the price tag. Seven in 10 Americans attribute the cost of the piece as the number one reason to insure their jewelry. And for good reason! Our timeless treasures are often worth several pretty pennies, with the national average cost for the most expensive piece of jewelry one owns at $1,907.

The roads are not the only icy things in Minnesota! At $3,447, Minnesotans have the most expensive jewelry piece on average. West Virginia ($3,445) and New Jersey ($3,160) round out the top three as the only other states with an average higher than $3,000. Conversely, Maryland residents have the least expensive piece on average at $702. Washington ($950) and Texas ($968) are the only other states with an average below $1,000.

All states opt to insure their bling rings more than anything else, so in this map every state’s second most commonly insured piece of jewelry is shown. For about 70% of states, it’s a watch. Despite the fancy chains that many celebrities don these days, necklaces aren’t the most commonly insured in any state. Instead, bracelets and earrings made up the most common items in the other 30% of the country.

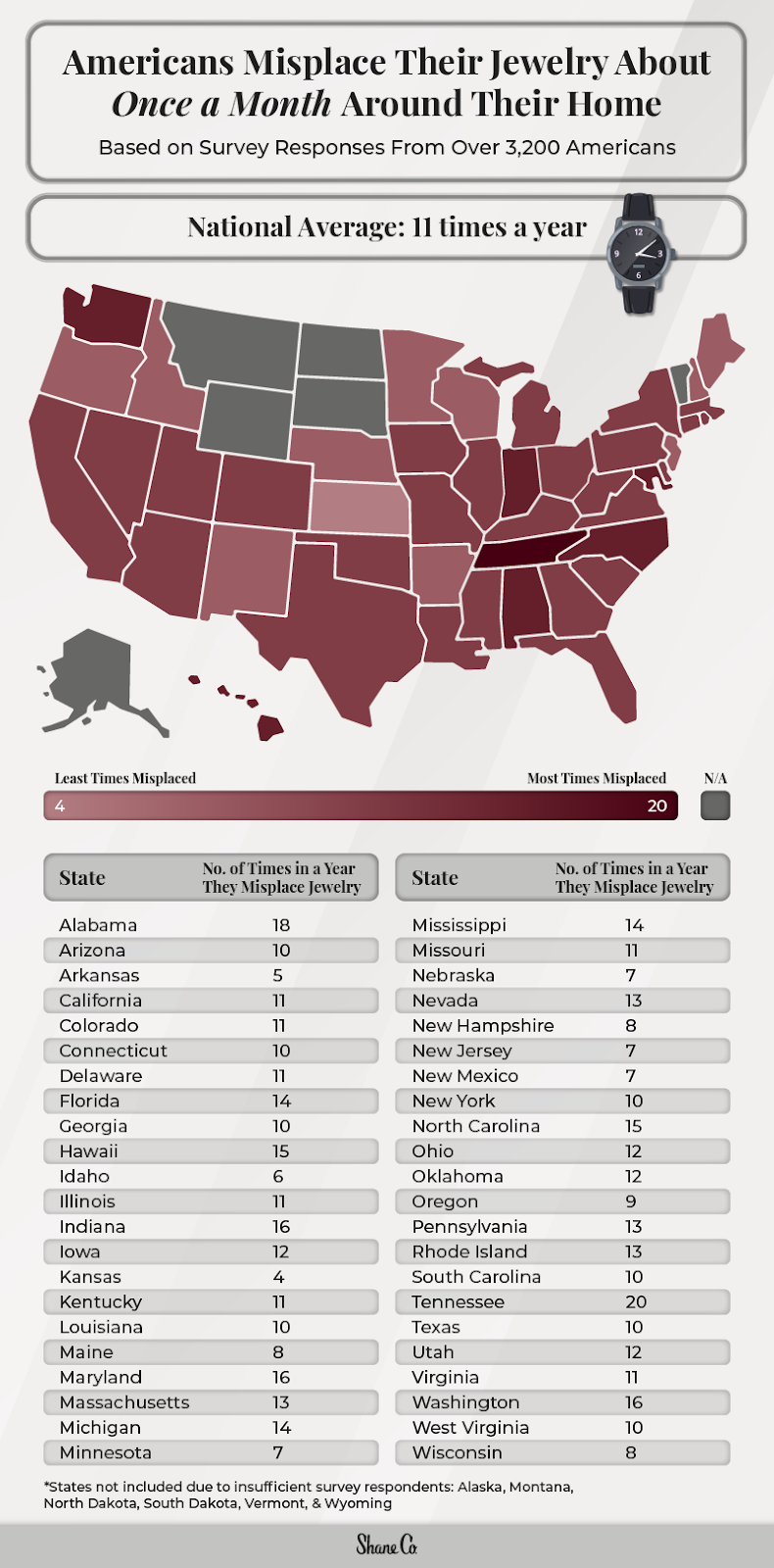

The States That Misplace Their Jewelry the Most & Least

In our busy lives, sometimes we’re the ones that cause our accessories to go missing. So much so that 31% of Americans are more worried about losing their jewelry than about it being stolen (27%). In a year’s time, the average American misplaces their jewelry 11 times.

Iowa, Ohio, Oklahoma, and Utah misplace their jewelry 12 times a year on average — that’s about once a month! Some states like Tennessee are a little extra absent-minded, losing theirs 20 times a year on average. Kansas keeps a close eye on their things, only misplacing jewelry once every three months, or four times a year.

The highest point of concern for jewelry protection, with 34% of Americans agreeing, is damage to the piece. All states agreed that their accessories are most at risk while cleaning around their home. Careful when trying to get your vacuum in those hard-to-reach areas!

Final Thoughts

No matter if it’s a timeless family heirloom, a beautiful symbol of love, or just something nice to wear out, we like to keep our jewelry protected. Safety practices like responsible storage and jewelry insurance can help mitigate the risks Americans are worried about, especially for their most valuable and cherished possessions.

Keep in mind these notes from Zillion when thinking about jewelry protection:

- Consumers are more interested in insuring their jewelry when it’s worth at least $2,000

- Jewelry insurance claims spike over the summer. People beat the heat by swimming, with their fingers contracting when they go from the hot sun to the cold water, often causing rings to slip off.

- The holidays also see a spike in jewelry insurance claims. During this season, people are traveling, packing, and more likely to lose their jewelry.

Make sure that you always file a missing jewelry report if you lose your jewelry! If your jewelry is turned into the authorities or shows up for resale, the report will show that you’re the owner.

Now that you know how to safeguard your gems, check out our selection of fine jewelry to complement your ensemble or gift to a special person. At Shane Co., we believe everyone is made to shine.

Methodology

To gain insights into the jewelry protection habits of Americans, we surveyed over 3,200 respondents across every U.S. state. Due to their lower populations, we could not make reasonable conclusions for Alaska, Montana, North Dakota, South Dakota, Vermont, & Wyoming to include. Our questions delved into the frequency at which they misplace jewelry, which pieces they insure, and their feelings and tendencies when it comes to theft, damage, and loss, among others. The survey was conducted in late September through early October of 2023.